how to declare income tax

Complete the form using the printed instructions. Employment income Declare income from your employer job including wages cash allowances and fringe benefits or super contributions.

U S Permanent Residents And Citizens Must Declare And Pay U S Taxes On Worldwide Income U S Green Card Reentry Permits

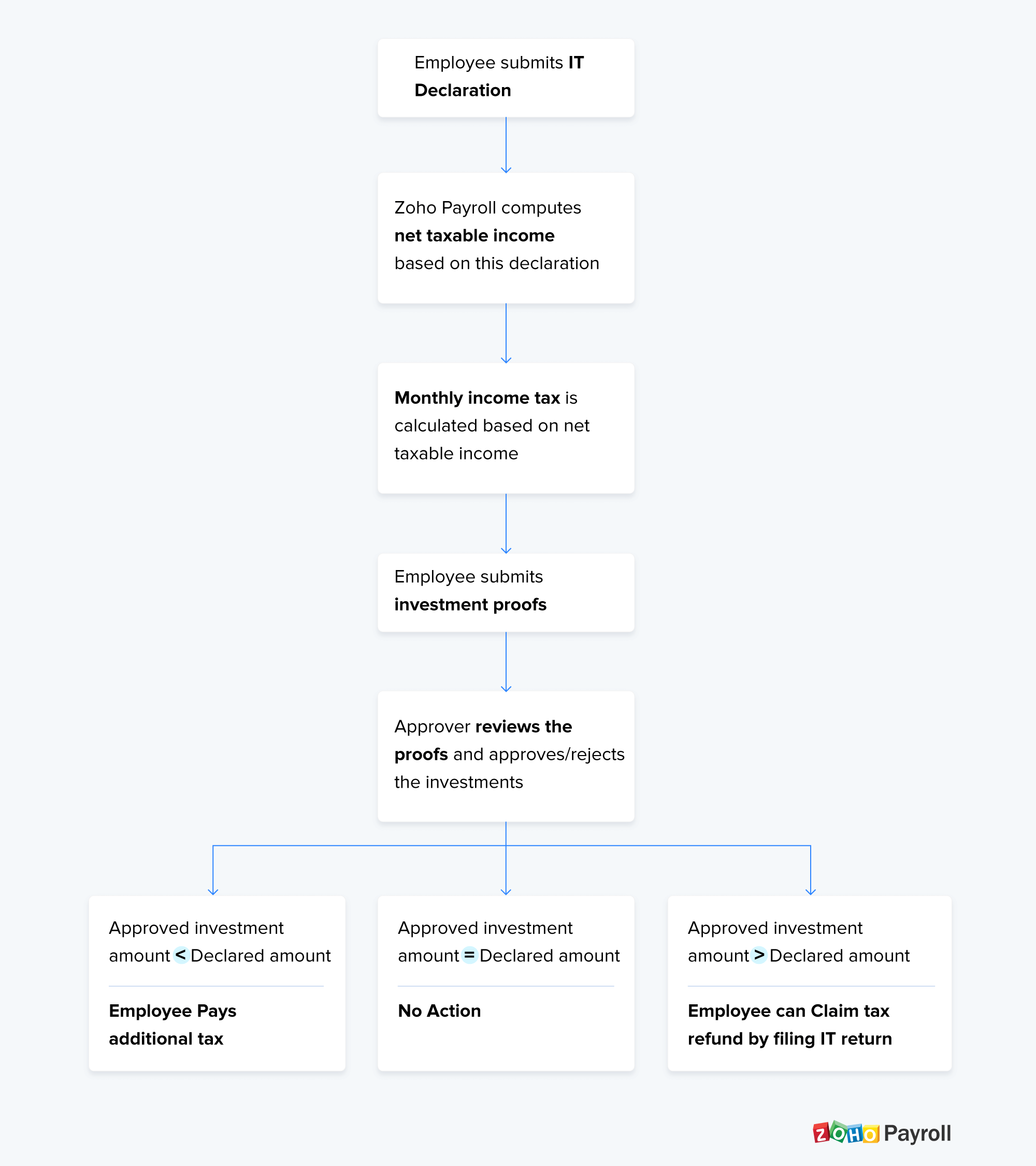

Efiling Income Tax ReturnsITR is made easy with Clear platform.

. Just upload your form 16 claim your deductions and get your acknowledgment number online. If you have to pay a penalty itll be lower than if HMRC find out about the income. You can declare unpaid tax by telling HMRC about rental income from previous years.

असधरण 297 VERIFICATION I further declare that I am making returns in my capacity as _____ Please choose from drop down menuand I am. The credit is a reduction of total income tax at the bottom of your return of 30 percent of the qualifying costs up to a max of 2000 in the year installation is. Effective January 1 2018 payers that maintain an office or transact business in CT and make payments of taxable pensions or annuity distributions to Connecticut residents are required to withhold income tax from such distributions.

The Australian tax system taxes the individual Ms Morton says. Up to the. A step by step guide on how you can file your ITR online.

How to file ITR on ClearTax - Steps to E-file Income Tax Returns Online for FY 2021-22 AY 2022-23. HM Revenue and Customs HMRC is reminding Self Assessment customers to declare any COVID-19 grant payments on their 2020 to 2021 tax returnMore than 27 million customers claimed at least one. Income you must declare.

Form 4506 Request for Copy of Tax Return PDF is used to request a copy of previously filed tax returns with all attachments. Gains on art and collectibles are taxed at ordinary income tax rates up to a maximum rate of 28 percent. Further you can also file TDS returns.

Know what documents are required to e-file and details of investments made along with the verification process. Super pensions and annuities. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card.

The Income Tax Course consists of 62 hours of instruction at the federal level 68 hours of instruction in Maryland 80 hours of instruction in California and 81 hours of instruction in Oregon. If your net rental income is over 5000 you will have to register for self assessment. Income Tax rates and bands The table shows the tax rates you pay in each band if you have a standard Personal Allowance of 12570.

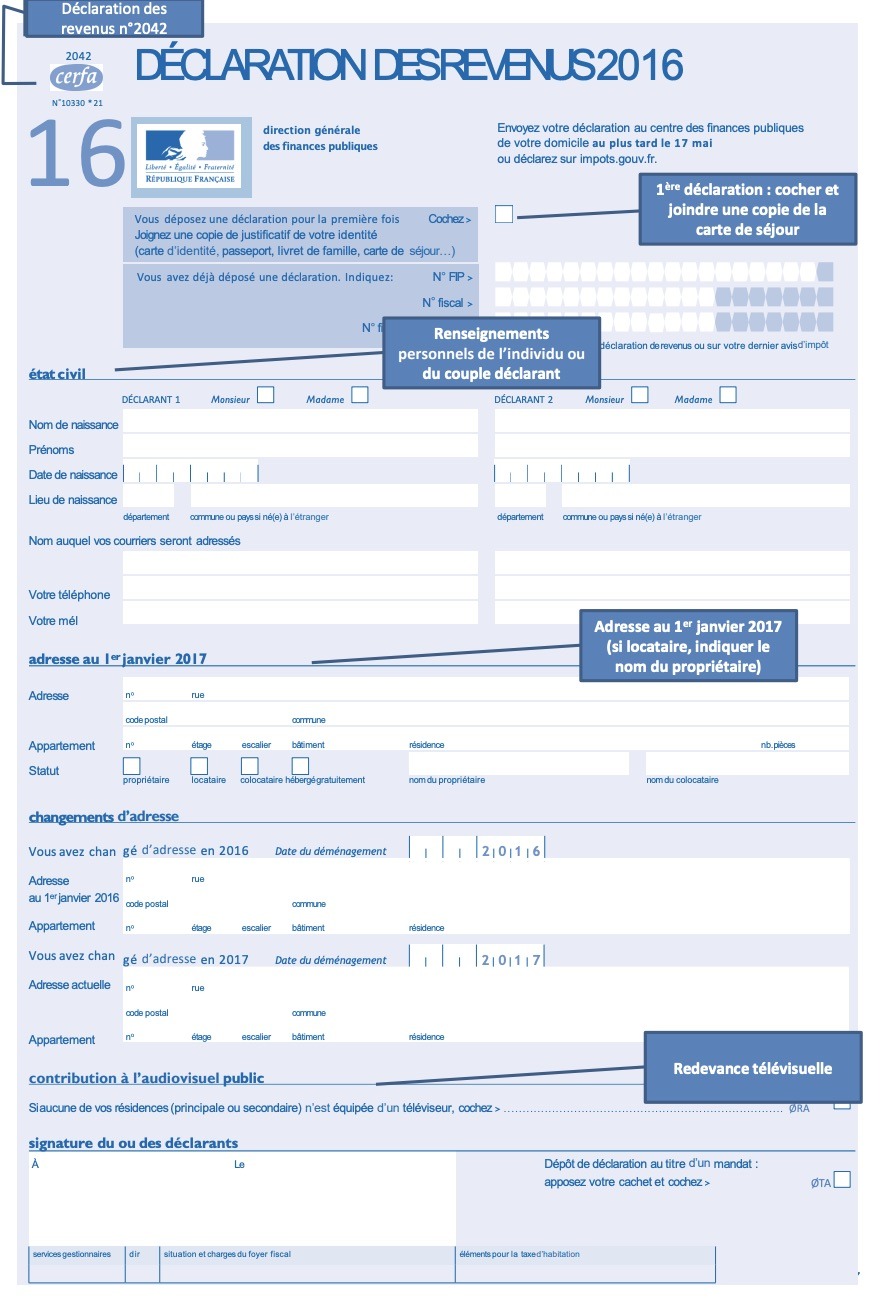

You must complete the following sections even if you have no income to declare. Form 4506 has multiple uses and special attention must be taken when completing the form for a gift tax inquiry. Fill in at least one code Section III A 51 - Etiez-vous soumis à la sécurité sociale en Belgique Were you subject to social security in Belgium.

The form and instructions are available on IRSgov. In the Non-PAYE Income page select Other Income and add Rental Income complete and submit the form. A popular choice is a Limited Liability Company LLC.

Tick code 10822082 yes or. Additional training or testing may be required in CA OR and. Work out which income you need to declare in your tax return such as employment government and investment income.

The Tax Counseling for the Elderly TCE program offers free tax help for all taxpayers particularly those who are. A person adopting the presumptive taxation scheme can declare income at a prescribed rate and in turn is relieved from tedious job of maintenance of books of account and also from getting the. To declare War grant Letters of Marque and Reprisal and make Rules concerning Captures on Land and Water.

If the foreign rental property is owned directly or through a Single Member Limited Liability Company which is considered a disregarded. It doesnt tax the family unit. Click on Review your tax link in PAYE Services.

Say you file individually have 50000 in income and get 1500 a month from Social Security. You both need to declare beneficial interests in joint property and income. You may be required to complete.

How much you get depends on your other income. The tax year runs from 6 April to 5 April the following year. You get these allowances each tax year.

Vacancies in the Senate. If your annual gross property income is 1000 or less from one or more property businesses you will not have to tell HMRC or declare this income on a tax return. Income-tax Act ie in case of a person not adopting the presumptive taxation scheme of section 44AD As amended by Finance Act 2022.

Up to 250000 500000 for married couples of capital gains from the sale of principal residences is tax-free if taxpayers meet certain conditions including having lived in the house for at least 2 of the previous 5 years. From 6 April 2020 Income Tax relief on all residential property finance costs is restricted to the basic rate of. Residents of Connecticut Receiving Income from Pensions or Annuities.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable servicesLocal taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent. Up to 85 percent of your benefits if your income is more than 34000 individual or 44000 couple. How you report your foreign rental income will be determined by the structure used to hold the ownership of the foreign property real estate.

Additional time commitments outside of class including homework will vary by student. The Volunteer Income Tax Assistance VITA program offers free tax help to people who generally make 58000 or less persons with disabilities and limited-English-speaking taxpayers who need help preparing their own tax returns. Income tax bands are different if you live in Scotland.

You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. Select the Income Tax Return for the year you wish to claim for. Although it does recognise elements of the family in other ways.

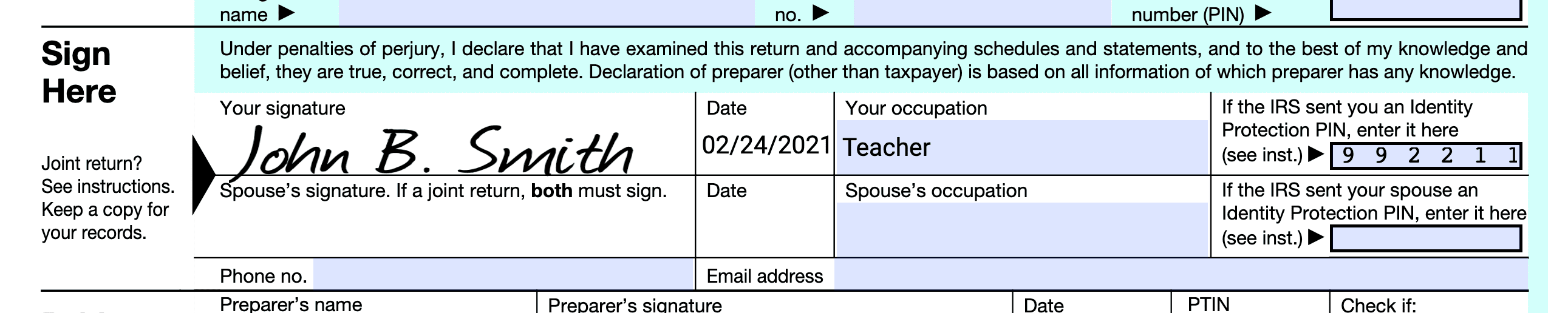

Under penalties of perjury I declare that I have examined this certification statement and to the best of my knowledge and belief the facts are true correct and complete. Which sections do you have to complete. Up to 50 percent of your benefits if your income is 25000 to 34000 for an individual or 32000 to 44000 for a married couple filing jointly.

The United States Supreme Court has ruled that requiring a person to declare income on a federal income tax return does not violate an individuals right to remain silent although the privilege may apply to allow the person to refrain from revealing the source of the income. Section III A 1 - Renseignements dordre personnel personal information. Foreign Property Ownership Structure.

The Intelligent Way To Declare Your Income As A Us Seafarer

Texas Cotton Industries Form 1120 U S Corporation Income Tax Return 1955 The Portal To Texas History

10411204 Form 1041 U S Income Tax Return For Estates And Trusts Page 1 2 Nelcosolutions Com

Earned Income Tax Credit Awareness Day January 28 2023 National Today

Simplifying Personal Tax Declaration

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Non Residents Declare Your Income Welcome To France

Do I Need To Declare My Income To The United States

Stori Za Ushuru What You Need To Know About Filing Income Tax Returns Facebook

How To File An Income Tax Return In Spain Expatica

Mailing A Tax Return To The Irs Or Your State

How To Complete The Fafsa When Parent Didn T File Tax Return Fastweb

I Own A Rental Property In State With No Income Tax Do I Still Need To Declare It Tfx User Guide

Why Declare Your Taxes In Paraguay

Mistakes To Avoid On Your Self Assessment Tax Return Freeagent

Self Declaration Of Individual Income Tax

How To File A Zero Income Tax Return 11 Steps With Pictures

Income Tax News Quickly Declare Winnings In Online Games By Filling Updated Itr Edules

0 Response to "how to declare income tax"

Post a Comment